Digital onboarding in banking

The pressure is on to release the pressure. How are digital products making onboarding easier and driving trust in financial services?

Like it or not, financial services businesses are expected to deliver the same pain-free, frictionless experiences customers have come to expect from digital interaction with any brand or service.

Smartphone pocket power has made it easier than ever to check your balance, transfer money, change currency, trade stocks, make investments. It all sounds simple enough.

But while those tasks have become considerably easier, is there a scenario where making them too easy could undermine the trust we put in our financial service providers?

And whatsmore, why is it still not always as good as it could be? According to a survey of nearly 7,600 European financial services consumers, 68% of customers are giving up before they’ve even started because of poor onboarding experiences. And even more worrying is that number has increased by nearly 60% year-on-year.

It’s not easy, making it easy

There are many reasons why delivering great digital experiences in financial services can be trickier than other industries, but the three big ones are…

The stakes are always high

Money might not grow on trees, but it does make the world go round. Estimates suggest the global economy is approaching 100 trillion USD and banks new and old are the custodians of that. So while Amazon Prime delays or slow broadband might be annoying, glitches in our financial services aren’t really an option.

There’s more regulation

Financial Services have to take the pain away from what are less than straightforward processes and all while navigating the regulatory waters of KYC (Know Your Customer) and AML (Anti Money Laundering), among others. Clearly financial services regulation should be more stringent than when someone orders a takeaway, but we all expect the process to be just as easy.

People don’t like managing their money

Perhaps most importantly, the biggest barrier is motivation. Tolerance for poor digital experiences is low at the best of times. But that’s even more heightened when it comes to managing your direct debits or checking your overdraft.

So financial services businesses have to tread a fine line of making onboarding as easy as everyone expects it to be, while ticking several trust boxes along the way.

The power of trust and confidence

“There’s a really important role around trust and confidence,” says Chief Product Officer at Chetwood Financial, Julia McColl. “Across all age groups, it’s really important to make it really simple, fair and transparent so customers know what decisions they're making and what impact it might have on their financial situation.

“The digital journey for financial services has a complexity to it. There’s the challenge of it not being a retail journey, which is all about speed and ease. And there's also this natural, healthy conflict that means you want people to consider certain decisions that are material for them in terms of their financial health.

“So you’re trying to balance this while still having people come out the other end saying ‘that was a really easy experience’. Because in reality none of us set aside the time to do these tasks - you’re trying to fit it in at the side of your desk at work or 10 mins before you leave for the airport to go on holiday.”

So how can great digital products help?

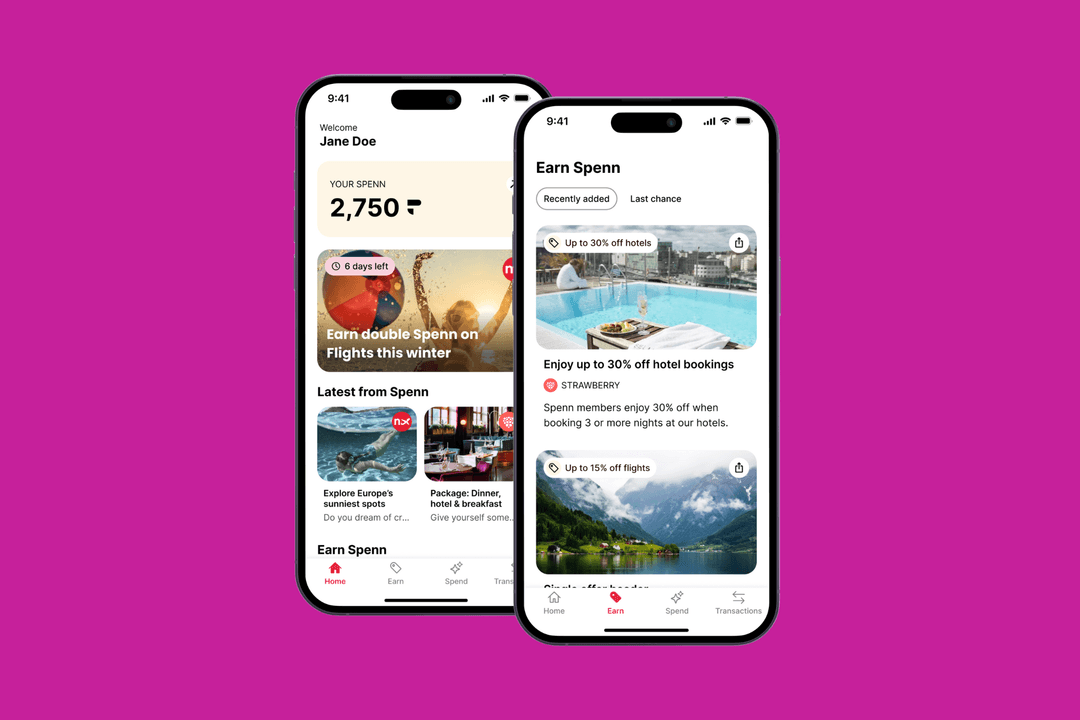

Be mobile and customer-first

At the heart of this dichotomy is of course mobile, and more specifically native applications, which are powerful tools for doing the double job of being both mobile-first and customer-first at the same time.

It’s not enough to be product-led. Customer needs have to shape your experience and your duty sits with them. And while reassurance can be provided by adding in a human element, there’s potentially more value in using that for problem-solving once a customer is onboarded. Getting started should and can be as automated as possible.

Faces and fingerprints

Tapping into the biometric data which already exists on devices can really help with this and has changed the game for KYC in terms of both ease of use as well as reliability.

There are huge cost savings both in reducing documentation, lowering resource and removing the need for in-person verification, not to mention easier compliance.

Onboarding and ongoing

Keeping the number of steps required during the onboarding process to an absolute minimum is essential. Make sure data being captured is only what’s needed for KYC, rather than trying to glean extra information which could be done in a cleverer and less cumbersome way later on.

KYC is also increasingly becoming something that needs to be thought about as part of the ongoing customer journey rather than just at the onboard stage, both from a regulatory perspective and for customer peace of mind.

Select the right tech

You have to make sure the right technology is in place, whether that’s reviewing the entire stack or creating efficient ways to integrate with legacy systems.

Investing in the right middleware should be considered as less of a sticking plaster solution and more of bona fide solution to shoring up existing systems. By brushing up the back-office, you can significantly improve the customer experience by speeding up decisions, improving communication and making the entire process more straightforward.

Good Financial Services need to nearly always be quietly brilliant and while great digital products can’t provide all the answers, they can go a long way to creating the necessary levels of trust and ease of use which can bring customers in and keep them coming back.

If you’d like to find out more about the work Apadmi does in financial services, we’d love to hear from you.

Share