5 Financial Services trends we’re excited to explore at Money20/20

by Vino Nandagopalan-Financial Services Growth Director|Wed Apr 30 2025

Europe’s leading financial services conference, Money20/20 in Amsterdam, brings together the brightest minds shaping the future of banking, payments, and fintech.

Apadmi’s mobile experts are excited to attend armed with questions alongside our own insights and experiences to share, as well as curiosity to explore current and future trends for the industry.

With mobile banking now the primary customer channel, and mobile-first expectations continuing to rise, we’re focussed on the innovations that deliver better outcomes — for customers and providers alike. Ahead of the event, here are the five mobile trends we’re most excited to explore with peers, partners, and industry leaders.

1. Mobile as the loyalty engine

Mobile isn’t just a channel anymore, it’s a crucial engine in any relationship with your customers.

According to FICO, banking customers who regularly engage with mobile apps have 72% lower attrition. When those apps are also intuitive, fast, and secure, customer satisfaction and retention soar.

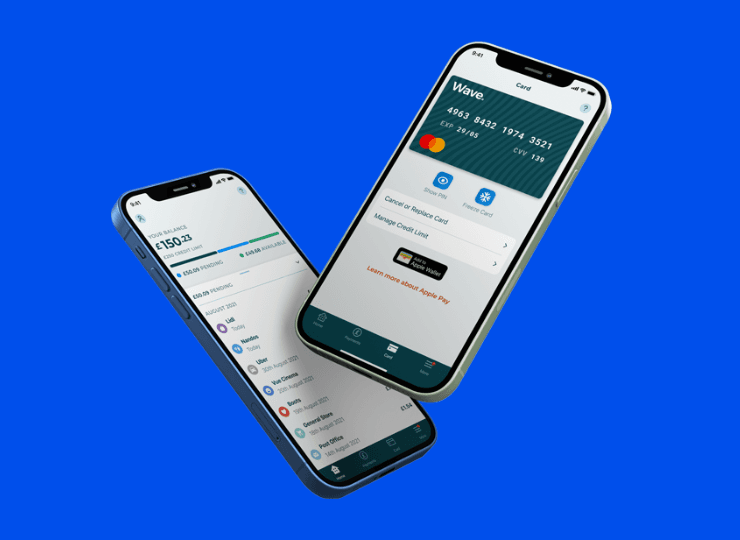

At Apadmi, we’ve helped large organisations such as Chetwood Financial, Ebury, Charles Stanley and Domino’s deliver seamless mobile experiences that streamline onboarding, enhance rewards, and drive user stickiness. With over £27 billion in annual transactions flowing through Ebury’s platforms, and over 80% of sales for Domino’s now via the app, we’ve seen how high-performing mobile journeys become not only functional, but powerful loyalty tools that drive engagement.

2. AI-powered personalisation that drives growth

Mobile platforms are uniquely positioned to capture and act on user data, but many financial firms still fall short of delivering meaningful personalisation.

The potential is huge: hyper-personalised experiences are linked to 40% higher revenue per customer according to BCG. At Money20/20, we’re keen to explore how financial providers are using AI and behavioural insights to tailor journeys, suggest smarter financial tools, and guide users through complex decisions.

From tailored self-service options to predictive product recommendations, there are more ways than ever to turn data into engagement.

3. The rise of digital identity and frictionless onboarding

78% of customers now prefer to open accounts digitally; yet onboarding friction remains one of the biggest reasons for drop-off and poor experiences are costing providers not just sign-ups, but trust.

That’s why digital identity is front-of-mind for us this year. At Apadmi, we’ve worked with financial institutions to streamline onboarding journeys, integrating secure identity verification methods without compromising user experience. For Chetwood Financial, we found that 99% of users rated the onboarding process we crafted as excellent, proving that a secure but frictionless experience can in fact be achieved with the right design-thinking and user-centric approach.

4. Speed-to-market gives a competitive advantage

From neobanks to embedded finance players, challengers are launching faster, iterating quicker, and winning new market share.

Traditional financial institutions often struggle to keep up — not for lack of ambition, but because legacy systems, risk appetite, and long development cycles create friction. That’s why we’re looking forward to talking to leaders at Money 20/20 about how to accelerate innovation without breaking stability.

Apadmi’s sprint-based model and mobile-first engineering approach enable up to 4x faster development cycles, helping FinTech companies and finance firms move from idea to MVP at speed. We're excited to see how speed-to-market is impacting the wider industry and adjusting customer expectations as a result.

5. Omnichannel experience with a single-customer view

Mobile may dominate, but customers expect seamless continuity across every touchpoint from app to web, contact centre to branch. And the brands that deliver on that promise are seeing the results: banks with omnichannel strategies enjoy a higher rate of 89% customer retention vs. 33% for those without.

We’re looking forward to hearing how firms are closing the channel gap, and sharing how smart back-end integration is enabling a single-customer view that supports real-time, cross-channel engagement.

It’s more crucial than ever for financial organisations to unify these journeys — making every customer interaction count.

Let’s connect in Amsterdam

Whether you're a fintech founder, a product leader at a traditional bank, or a payments innovator, we’d love to hear how you’re exploring these trends and more in your own organisations.

You can find myself, and our friendly mobile experts, at Money20/20 - reach out to us today to schedule a conversation at the event, or at a time and place that suits you (we have multiple offices and teams across Europe).

Share