The future of mobile payments: What’s next for digital wallets?

by Apadmi|Sun Jul 27 2025

Mobile payments and digital wallets have become integral to the way we interact with the world, from ordering your morning coffee to transferring money across the globe. The future of these systems also promises even more convenience, security, and innovation.

Businesses that can harness the power of digital wallets will not only stay ahead of the competition but also provide an enhanced customer experience.

How have mobile payments evolved?

The journey from physical to digital payments has been remarkable.

From cash to cards, and now mobile wallets

Not long ago, cash was the king of transactions, but with the rise of credit cards in the mid-20th century, how we pay for goods and services saw a dramatic shift.

Fast-forward to today, as technology has progressed, mobile phones have become a huge part of our everyday lives, and the introduction of mobile wallets was inevitable. Apple Pay, Google Pay, and Samsung Pay all brought the concept of ‘paying with your phone’ into the mainstream.

In many parts of the world, digital wallets have surpassed credit and debit cards in popularity — in fact, there were 4.3 billion global digital wallet users in 2024, which accounts for around 53% of the population.

In the UK, for example, 2 in 5 online purchases were made using a digital wallet. This shift towards digital payments reflects broader consumer expectations for speed, simplicity, and security.

The rise of contactless payments

Contactless payments have also gained traction in recent years, especially during the COVID-19 pandemic, as people sought touchless ways to make transactions. In 2024, there were 18.9 billion contactless transactions in the UK, marking a 3.4% increase compared to 2023.

Mobile wallets, which integrate seamlessly with Near Field Communication (NFC) technology, allow users to make payments with a simple tap of their phone, without the need for a physical card.

These types of payments are not only faster but also offer enhanced security compared to traditional card swipes, reducing the risk of fraud. For businesses, adopting contactless payment systems can help streamline operations, reduce wait times, and improve customer satisfaction.

The key drivers of change in the mobile payment space

Several factors are accelerating the evolution of mobile payments. From banking apps to cutting-edge technologies, these innovations are reshaping the way digital wallets work.

Increasing adoption of mobile banking apps

More consumers are shifting towards mobile-first solutions, especially when it comes to managing their finances.

Banking apps now offer more than just the ability to check balances or make transfers — features like mobile check deposits, personal finance management, and instant bill payments have made them necessary tools for daily financial activities.

For users, this means interaction with mobile banking apps is essential. As a result, we’re seeing more seamless payment experiences where users can quickly incorporate their banking app into their digital wallet with minimal friction.

The role of AI and machine learning in mobile payments

The potential for AI in mobile payments is vast. From predictive analytics that anticipate users' purchasing behaviour to fraud detection systems that analyse spending patterns, AI is transforming how payments are processed.

Machine learning algorithms can flag potentially fraudulent transactions in real time by comparing current behaviour with historical data. This capability significantly reduces fraud and enhances security for both users and businesses.

Blockchain and cryptocurrency’s influence on mobile wallets

Blockchain technology is making significant strides in reshaping how we think about financial transactions. While cryptocurrency remains a volatile and niche asset for most people, its underlying blockchain technology is revolutionising the payment space.

As of 2025, it’s estimated that over 560 million people use blockchain technology worldwide, whether directly through cryptocurrency ownership or indirectly through another application.

By offering transparent, secure, and decentralised payment methods, blockchain has the potential to eliminate intermediaries and reduce transaction fees. Some digital wallets, like PayPal, are already integrating cryptocurrency features, allowing users to store, buy, and trade crypto assets alongside traditional currencies.

What to expect for the future of digital wallets

Looking ahead to the future, digital wallets will become even more important and integral to our daily lives. From enhanced security features to the rise of personalisation, there’s plenty to look forward to.

Advanced security features

Security has always been a top priority in the mobile payment space, and future advancements will take it to the next level, but what do we currently use?

Biometric authentication methods, such as fingerprint and facial recognition, have become increasingly common, providing an added layer of protection.

Encryption technology also plays a vital role in safeguarding sensitive information.

However, the future will bring even more sophisticated security measures, such as voice recognition and behavioural biometrics, which will analyse a user’s unique patterns, like how they interact with their phone and hold their device.

Integration with IoT and wearable technology

Digital wallets will soon be integrated with a wide range of connected devices, like smartwatches, fitness trackers, and even smart glasses — some products already have this capability. This will allow users to make payments seamlessly by simply tapping their smartwatch or using voice commands through a smart speaker.

The key benefit of this integration is the convenience it provides. With payments happening on the go across multiple devices, users can enjoy a frictionless experience where transactions occur smoothly, no matter what device they’re using.

Personalisation and loyalty programs

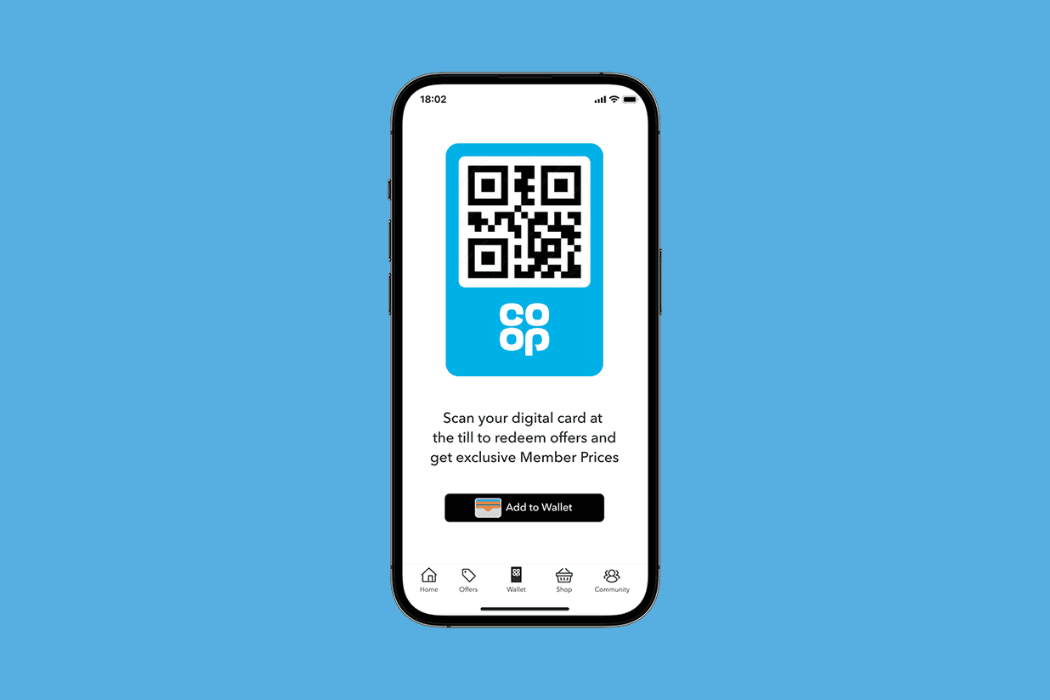

Mobile wallets can also influence the way loyalty programs work. By integrating payment systems directly with loyalty programs, users are able to earn rewards and receive discounts directly through their digital wallet. This eliminates the need to carry physical loyalty cards and allow for instant rewards at the point of payment. Our clients such as Co-op and Asda both use mobile wallets to make loyalty a seamless experience for customers.

Mobile wallets also leverage personalisation by tracking a user’s spending habits, location, and preferences, allowing them to offer tailored rewards that feel more relevant to each person.

How can businesses adapt to these trends?

As digital wallets and mobile payments continue to evolve, businesses must adapt to stay competitive.

Upgrade payment infrastructure: As mobile payments become more mainstream, businesses need to ensure their payment infrastructure is equipped to handle this. Upgrading point-of-sale systems to accept digital wallets or investing in mobile app development for seamless transactions can be a good start. Businesses must also ensure their payment systems are secure and compliant with the latest standards to safeguard customer data.

Focus on user experience: The customer experience will be central to the future of mobile payments. Offering an intuitive payment experience will make businesses stand out from their competitors. This involves creating easy-to-navigate mobile wallets and payment systems that work effortlessly across all devices. Businesses must stay focussed on optimising their payment interfaces to meet changing consumer expectations.

Staying ahead with innovation: Keeping up with emerging technologies, like AI, blockchain, and IoT, will provide customers with the most innovative solutions. Businesses that embrace this and adapt to new trends will be the ones leading the charge. It’s not just about keeping up with current trends; it’s about anticipating what’s next and proactively offering solutions that enhance the customer experience.

Stay ahead in the digital payment revolution

At Apadmi, we specialise in crafting mobile solutions that meet the needs of users and provide tangible results. Get in touch with us today to find out how we can help you optimise your digital products or learn more about our services.

Share